Plan for your Business

and your family

Prepare now so that you (or your family) do not have to pay later

With 25 years of experience, Pattie S. Christensen is a business and estate planning attorney that offers one-on-one service to clients who have been referred to her by the client’s professional advisors.

Welcome to the website for the law practice of Pattie S. Christensen. Ms. Christensen works by referral only. If you are new to working with Pattie, please read the New Client Rules before proceeding in order to ensure that Ms. Christensen is the right fit for you. Next, please go to the category that best fits your needs and follow the instructions there.

Pattie is also an official Utah Remote Notary and notarization for Utah clients may take place via online meeting for those who are limited in their ability to travel.

We are the layer of Privacy between your business and the public.

Plan for your Business

and your family

Prepare now so that you (or your family) do not have to pay later

With 25 years of experience, Pattie S. Christensen is a business and estate planning attorney that offers one-on-one service to clients who have been referred to her by the client’s professional advisors.

Welcome to the website for the law practice of Pattie S. Christensen. Ms. Christensen works by referral only. If you are new to working with Pattie, please read the New Client Rules before proceeding in order to ensure that Ms. Christensen is the right fit for you. Next, please go to the category that best fits your needs and follow the instructions there.

Pattie is also an official Utah Remote Notary and notarization for Utah clients may take place via online meeting for those who are limited in their ability to travel.

We are the layer of Privacy between your business and the public.

Prepare for your Consultation

Select the accurate form

Interested in Working With Me?

This is a must read

If you want a “PHONE CALL” or “MEETING”, please go to, https://calendly.com/pchristensenesq

You can schedule and pay for the call or meeting there. Unscheduled telephone calls are “NOT ACCEPTED“.

The order of emails sets the queue for work. So for fastest service, please email.

Note that the queue is based on the last email received for a matter. Hence, please have all of your information handy when sending an email.

Please do not send any legal requests at all via text. Text is not regularly monitored. Conversations will not happen via text.

Failure to plan does not equate to an emergency on Pattie’s part. If you sit on a project before telling Pattie, she gets to sit on the project for the same amount of time before starting to work.

Billing is based on hourly rates, charged in tenths of an hour. The normal rate for Pattie Christensen is $300 per hour, with a $50 an hour discount for professional referrals. The rate for rush jobs (those requiring turn around in 48 hours or less) and unscheduled telephone calls and office visits is $450 per hour rounded up to the next half hour. Standard LLCs and corporations are typically billed at $500 plus the applicable state filing fee. Any custom drafting is charged at the hourly rate.

Bills are sent out on a monthly basis. Payment is expected within 15 days unless prior arrangements have been made. Bills that must be resent due to nonpayment are subject to a $15 reprint fee. Clients who are delinquent in payment may have their rates increased by $50 per hour or may be “FIRED” as a client. Accounts over two months delinquent may be referred to a professional collection agency and you will be responsible for any and all costs associated therewith. If you suspect you may have payment problems, please discuss this matter with Pattie in advance. If you have a question about a bill, please contact the office before the due date.

If you would prefer to pay by credit card, you may do so at our secure online bill payment center. Go to,

https://www.pscllc.com/billing. Please note that you are entering your information directly into the merchant gateway so the office does not have any access to your credit card number. You will receive a confirmation email to the email address you provide. You can also pay by “Zelle” to pchristensen@pattiechristensen.com with the phone number (801) 878-7872.

Pattie does transactional work only. Absolutely no litigation, divorces, bankruptcy, criminal or any other contentious work will be performed.

Pattie is a sole practitioner and as such is unable to accommodate clients who need lots of hand holding or baby sitting. Reminders are only sent if specifically requested by the client and agreed to by Pattie. Likewise, as a sole practitioner Pattie is not able to provide strictly administrative work.

Registered Agent Services are $50 per year payable in arrears, which includes the $20 per year state filing. If you need changes to an entity or no longer wish to have it renewed, you must notify Pattie immediately.

All clients are required to have valid email addresses on file with Pattie at all time.

Interested in working With Me?

This is a must read

If you want a “PHONE CALL” or “MEETING”, please go to, https://calendly.com/pchristensenesq

You can schedule and pay for the call or meeting there. Unscheduled telephone calls are “NOT ACCEPTED“.

The order of emails sets the queue for work. So for fastest service, please email.

Note that the queue is based on the last email received for a matter. Hence, please have all of your information handy when sending an email.

Please do not send any legal requests at all via text. Text is not regularly monitored. Conversations will not happen via text.

Failure to plan does not equate to an emergency on Pattie’s part. If you sit on a project before telling Pattie, she gets to sit on the project for the same amount of time before starting to work.

Billing is based on hourly rates, charged in tenths of an hour. The normal rate for Pattie Christensen is $300 per hour, with a $50 an hour discount for professional referrals. The rate for rush jobs (those requiring turn around in 48 hours or less) and unscheduled telephone calls and office visits is $450 per hour rounded up to the next half hour. Standard LLCs and corporations are typically billed at $500 plus the applicable state filing fee. Any custom drafting is charged at the hourly rate.

Bills are sent out on a monthly basis. Payment is expected within 15 days unless prior arrangements have been made. Bills that must be resent due to nonpayment are subject to a $15 reprint fee. Clients who are delinquent in payment may have their rates increased by $50 per hour or may be “FIRED” as a client. Accounts over two months delinquent may be referred to a professional collection agency and you will be responsible for any and all costs associated therewith. If you suspect you may have payment problems, please discuss this matter with Pattie in advance. If you have a question about a bill, please contact the office before the due date.

If you would prefer to pay by credit card, you may do so at our secure online bill payment center. Go to,

https://www.pscllc.com/billing. Please note that you are entering your information directly into the merchant gateway so the office does not have any access to your credit card number. You will receive a confirmation email to the email address you provide. You can also pay by “Zelle” to pchristensen@pattiechristensen.com with the phone number (801) 878-7872.

Pattie does transactional work only. Absolutely no litigation, divorces, bankruptcy, criminal or any other contentious work will be performed.

Pattie is a sole practitioner and as such is unable to accommodate clients who need lots of hand holding or baby sitting. Reminders are only sent if specifically requested by the client and agreed to by Pattie. Likewise, as a sole practitioner Pattie is not able to provide strictly administrative work.

Registered Agent Services are $50 per year payable in arrears, which includes the $20 per year state filing. If you need changes to an entity or no longer wish to have it renewed, you must notify Pattie immediately.

All clients are required to have valid email addresses on file with Pattie at all time.

We provide superior customer service

with an eye and mind towards details.

Practice Areas

Whether your needs are simple or complex, we can help you prepare the necessary documents to reflect your desires. Common documents are trusts, wills, powers of attorney, medical directives, deeds and assignments. The process will be very educational and your questions will be answered. Plus you will be given summaries and checklists for future reference.

Whether it is forming the entity or creating contracts and agreements, we are with you as much as you need. We are happy to work with your CPA as needed to get you the desired results. We can help you as you grow with things such as employment agreements, earn in agreements, reviewing loan documents, and more. We can be your registered agent if needed.

Protecting your logos and taglines is vital as you grow your business. Let us help you research and file your trademarks. There are a number of requirements and restrictions with trademarks that will be explained to you as part of the process.

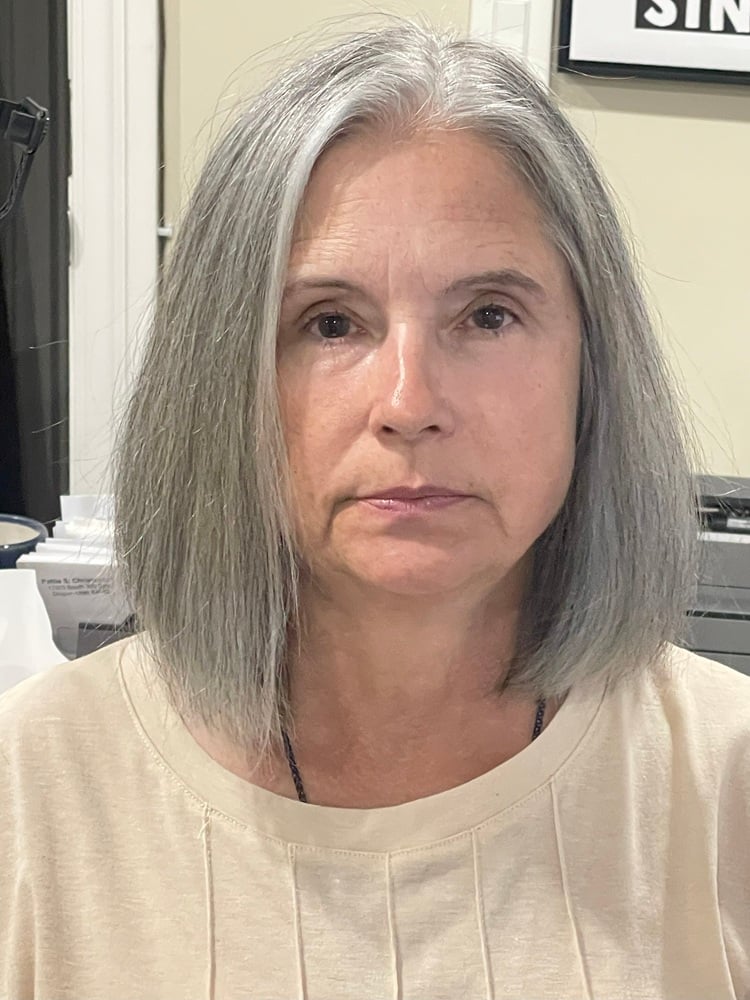

Pattie S. Christensen Esq.

After a stint as an air traffic controller, Pattie Christensen began practicing law in 1997. She found the traditional law firm approach to be too inconvenient and costly for clients. To better serve her clients, Pattie became a sole practitioner starting in 2000.

Expertise

Ms. Christensen is an attorney with twenty five years of experience. Her practice emphasizes estate and business planning. She has composed several publications for use in continuing public education courses on the topics of businesses, trusts and charitable giving. Ms. Christensen has acted as general counsel for a number of companies.

Education

University of Maryland, Masters of Technology Entrepreneurship 2021

Reuben Clark Law School, J.D. 1997 cum laude

University of the State of New York, B.S. Accounting, 1992

Informed Decisions Are Best

Gain clarity in these areas

Strategies for Reducing Wealth and Transfer Taxes

A. Lifetime Gifts The current gift tax program permits a person to transfer up to $18,000 (2024) worth of gifts of a present interest per

Deciding On A Business Type

So you have a great business idea. Now it’s time to form the company. Partnership? LLC? S-corp? C-corp? There are three basic entity types: partnerships,

Estate Planning for Alternative Lifestyles*

Whether or how one uses the term “alternative lifestyle” aside, the laws surrounding estate planning are predicated on a certain family structure. That family structure

My Availability

Pattie in Draper

Pattie in St George

- September 01 – 31 October, 2025

- November 03 – No Where

- November 17 – November 21, 2025

- December 08 – December 12, 2025

- December 29 – January 02, 2026

- January 19 – January 23, 2026

- February 09 – February 13, 2026

- March 02 – March 06 , 2026

- March 23 – March 27 , 2026

- April 06 – April 10, 2026

- April 20 – April 24, 2026

- November 04 – November 14, 2025

- November 24 – December 05, 2025

- December 15 – December 26, 2025

- January 05 – January 16, 2026

- January 26 – February 06, 2026

- February 16 – February 27, 2026

- March 09 – March 20, 2026

- March 30 – April 03, 2026

- April 13 – April 17, 2026

- April 27 – April 30, 2026

- *****